Summary: In this Article, you’ll get to read about —

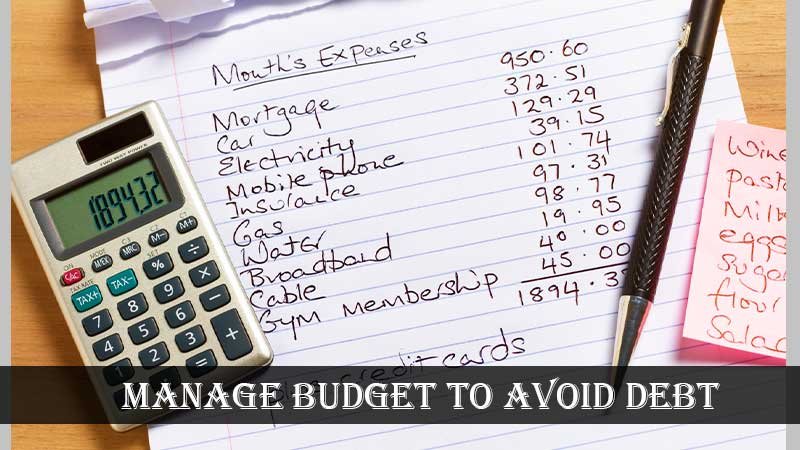

Budgeting is an essential yet underrated topic for most individuals and small business owners. So, the main aim of today’s writing is to help you maintain expenses in the best possible way. Thus, if you are suffering from a lack of cash, and uncontrolled cash flow then budgeting is the best way to get out of this vicious cycle. An intelligent person knows when to take the right actions. However, budgeting is one of those techniques that you can do yourself to get out of debt. In simple words, it’s just a plan for your money. But if you want it properly, then there are specific tips that you will have to follow. We start with the following:

What is the Importance of Budgeting to Get Rid of Debts?

“According to 72% of people, budgeting helped them to live a debt-free life.”

Budgeting gives you an action plan and helps you see the bigger picture of your finances. In this technique, you decide the inflow and outflow of your money in advance. Above all, it’s the best thing that helps you achieve goals, whether you want to get out of debt or save for retirement. It also helps in daily life like household management or grocery shopping. Apart from this, the budget gives you more freedom in spending. As a result, you can spend the money without even feeling guilty. If we look at the bigger picture, many people can find extra money to support other activities. So, it’s safe to say that budget is a core thing, whether personal financial management or brand development.

Major Rules to Follow in Budgeting:

Many people find budget management a difficult subject. But with the proper understanding, you can follow your money so easily. Here are significant rules in budget management that you need to understand.

- 50-20-30 rule: It is a money management technique that divides your income into three categories. However, we divide 50% for essentials, 20% for savings, and 30% for other things.

- Envelope system: It is another system where you take 3-5 envelopes. However, you write down why you need this percentage of money on these envelopes. Later, you get cash from that specific envelope to cover expenses. In this way, you can keep proper track of the money and avoid debt.

- 80-20 plan: This rule is for people who find an envelope and a 50-30-20 rule complex. So, in this simple rule, we categorize expenses that are essential and non-essential. Later, you keep 80% for all costs and put 20% in your savings account.

But it’s also vital to understand the difference between essentials and non-essentials. So, here are the expenses that we divided into each category.

| Essentials | Savings | Other things |

| Rent | Saving accounts | Clothing |

| Housing costs | Retirement contributions | Restaurants |

| Groceries | Loans | Subscription fee |

| Gas etc. | Credit card payments | Gym and other expenses |

Apart from this, always keep in mind that the percentage could be different, depending on the financial situation. So, before making a budget run a quick personal financial analysis.

Tips to Follow in Budgeting to Avoid Debt:

Debt is one of the core things that work against your financial health. In simple words, we can say it’s your enemy. So, if you want to grow financially strong, then adopt good habits like budgeting. But here are tips that will help you throughout the journey.

Track Your Expenses:

If you are regularly making purchases, you will not be able to add much in savings. So, to avoid debt, you should keep track of your expenses along with spending habits. For instance, choose a spending plan wisely and stick to that through thick and thin. It’s up to you, and you can make a budget as detailed as possible. Apart from this, if you are running your own business, take help from an invoice generator to keep track of expenses. You also have the option of following ZERO-BASED BUDGET RULE to know where exactly your money is going. The simple thing is to track your expenses and spend less than you earn.

Learn to Make Adjustments:

If you have made a budget, your work doesn’t end here. There are many things that you need to adapt to keep the budget balanced. For instance, if gas is expensive and takes a big chunk of the budget, then use public transport instead. According to the results of a budgeting survey:

“More than half of the people say that budgeting is a group effort, and you can’t make it successful all alone.”

In addition to this, there are other things like electricity, education costs, and other seasonal things and demand a flexible budget.

Include Expenses Even If They are Small:

Most people follow this habit and don’t include tiny expenses in the budget. But this isn’t the right approach. If we look at the stats, if you spend $2.50 on a vending machine, it’s around $625 per year. So, by missing small purchases, you can underestimate your budget. These expenses are non-necessary, and if the costs are overflowing, you can cut down on these wants.

Don’t Ignore to Build an Emergency Fund:

We can’t focus more on the importance of emergency funds to break the vicious debt cycle. According to experts:

“You should save a salary that is equal to 3-6 months of essential expenses.”

It’s the best tip to follow if you are working as a freelancer or your work is seasonal. If you don’t prepare an emergency fund, you will have to go towards a credit card, and it is one form of debt. Furthermore, if you make an expense from the emergency fund, try to recover it as soon as possible.

Review Credit Card and Interest Payments:

We discourage using credit cards if you want to live a debt-free life. But if it’s unavoidable to use in a few cases, it’s a must to settle these payments on a priority basis. If you fail, you will have to deal with late fees and missed charges. Moreover, if payments are piled up, it would be tough to get out of the debt.

Conclusion:

Budgeting is of utmost importance even if you have inconsistent income. You only need to stay consistent and add those things that are in immediate need to get in order. Apart from this, don’t forget to prioritize expense categories to know where exactly your money is going. So, set small goals and try to achieve them by adopting flexible budgeting strategies and tips. You also can take professional help if you are making a business-related budget.